We help high-income families create more than legal documents. We help them build legacy systems that unite generations and prevent the breakdowns that derail even the best financial plans.

Book a Discovery Call and take the first step toward clarity, protection, and peace of mind.

Most estate plans are written for attorneys, not for families.

They’re complicated, costly, and hard to update.

They sit in binders or filing cabinets, rarely discussed.

They transfer money, but not clarity or conversation.

What’s missing? Communication. Simplicity. Accessibility.

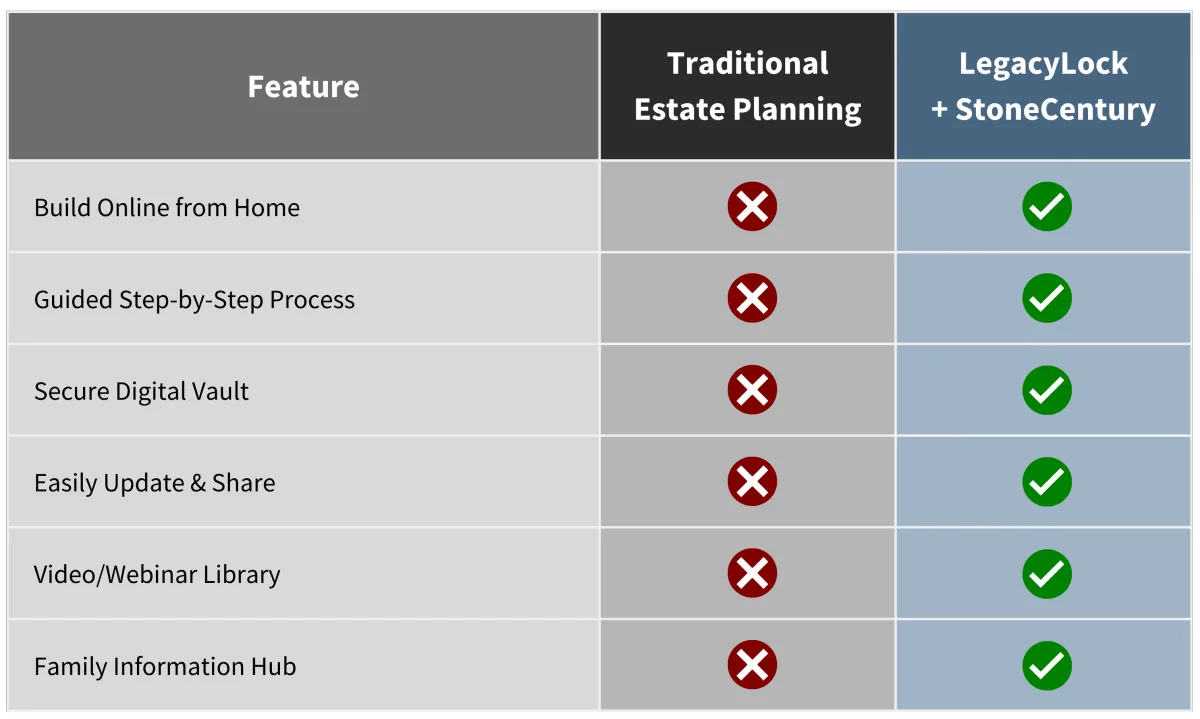

That’s why we use LegacyLock, an innovative digital estate planning platform that helps you:

Build your plan from home, with guided support.

Keep everything organized, updated, and accessible to your family.

Reduce attorney fees and minimize legal headaches.

“Legacy isn’t about documents. It’s about direction.”

Parents who want to ensure their children are prepared, not just provided for.

Business owners looking to protect and pass on what they’ve built.

High earners seeking privacy and control without costly legal friction.

Families who want to minimize conflict and maximize clarity.

This is not the dusty binder approach. This is a modern, intuitive, values-driven system.

With our guided process, you’ll create:

A Legally Sound Estate Plan: Including a living trust, will, power of attorney, and healthcare directive.

A Secure Digital Vault: All of your critical documents, contacts, and instructions in one place.

A Family Information Hub: Where your loved ones can access guidance and clarity when it matters most.

You don’t just make decisions. You organize, document, and share them.

The result? A plan that’s not only structured, but also visible, understandable, and actually usable.

Imagine your family during one of life’s hardest transitions, not stressed, not searching for documents, not wondering what you would have wanted.

They’re calm. They’re clear. And they’re unified.

They know where everything is, what decisions need to be made, and who’s responsible. Why? Because you made a plan and shared it with them before it was needed.

That’s what this system makes possible.

We’ll walk you through it step by step, start to finish.

LegacyLock combines technology with personal guidance. Here’s how it works:

Discovery

We walk through your goals, family structure, and the principles you want to preserve.

Plan Creation

Through our secure online portal, you complete your estate plan while we guide you through every step.

Legal Review & Execution

Once finished, your plan is reviewed for accuracy and compliance, then finalized with your legal team.

Ongoing Support

Life changes. Your plan should keep up. We keep everything current, coordinated, and accessible for your family.

“A strong legacy plan removes fear, reduces friction, and protects your loved ones when they need it most.”

When your estate plan is structured with clarity and shared intentionally, you give your family:

Confidence that everything is accounted for and accessible

Relief from legal fees, court delays, and uncertainty

Protection from probate and unintended consequences

Unity in the midst of life’s hardest moments

And most importantly, you give them a plan they can follow, not just a pile of documents.

Preparedness: Your loved ones don’t just inherit. They know what to do and why it matters

Simplicity: Everyone knows where to look, what’s included, and how to execute the plan

Continuity: The values that built your wealth don’t stop. They carry forward into the next generation

This is legacy planning designed for real life.

We’ll guide you through every detail: your values, your documents, your family’s future. It’s simpler than you think, and more powerful than you can imagine.

Let’s build a legacy your family can trust—and follow.

*Disclaimer: Financial Advisors do not provide specific tax/legal advice and this information should not be considered as such. You should always consult your tax/legal advisor regarding your own specific tax/legal situation. Separate from the financial plan and our role as a financial planner, we may recommend the purchase of specific investment or insurance products or account. These product recommendations are not part of the financial plan and you are under no obligation to follow them. Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods.