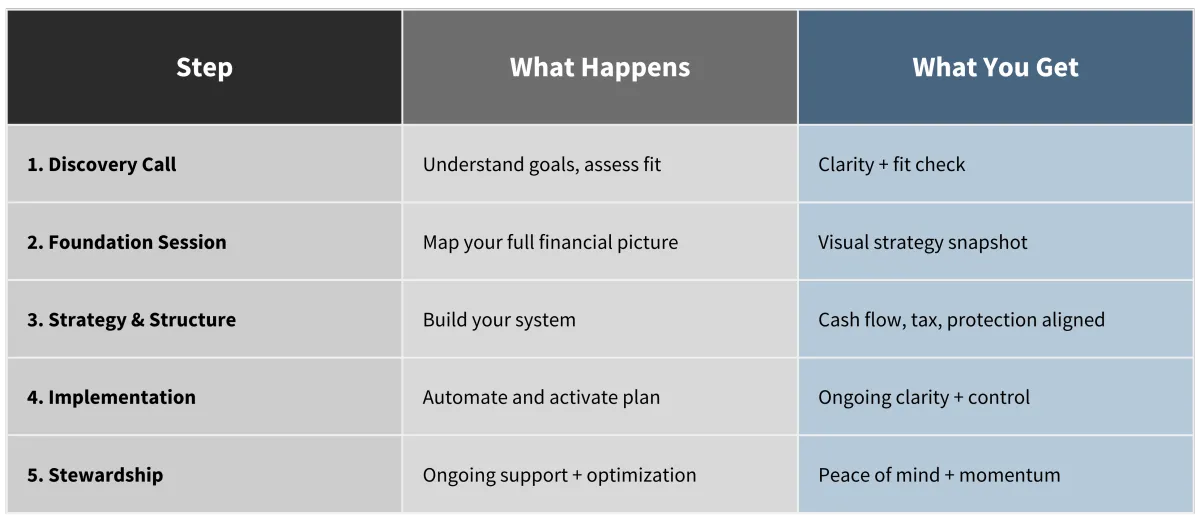

Our process is collaborative, educational, and structured to give you clarity from day one.

Every relationship begins with a 60-minute Discovery Call. No pressure. No pitch. Just a chance to understand your goals, priorities, and pain points.

We’ll learn:

What you’ve built so far, and what’s missing.

What frustrates or concerns you about your current strategy.

What outcomes would make the next 3–5 years feel like a win.

You’ll learn:

How our approach works.

What kind of outcomes we deliver.

Whether StoneCentury feels like a fit for you.

If we move forward, our first engagement is a 90-minute deep dive into your full financial picture: cash flow, taxes, protection, liabilities, goals, and more.

We’ll:

Map everything into our LEAP Model for full visibility.

Identify gaps, overlaps, inefficiencies, and opportunities.

Begin to design the outline of your optimized system.

You’ll walk away with:

A visual one-page snapshot of your financial world.

A list of your top strategic priorities.

New clarity about what’s possible.

Now we build.

Over the next 60–90 days, we co-create your wealth structure, including cash flow systems, risk protection, tax strategies, and legacy design.

You’ll get:

A personalized cash flow system (28%+ average savings rate).

Strategic coordination across all moving parts.

Guidance and implementation support every step of the way.

We also coordinate with your CPA, attorney, or other key advisors to ensure alignment.

We don’t just create strategy. We help you activate it.

That includes:

Updating or initiating insurance, trusts, or investment plans.

Setting up dashboards or reporting systems.

Everything is designed for clarity, momentum, and control.

“Most people don’t need more information. They need a system they can trust.”

We don’t disappear once your plan is built.

Through regular check-ins, review meetings, and real-time support, we help you:

Adjust your system as your income, goals, or life evolves.

Coordinate new opportunities with your existing plan.

Continue growing, not just financially, but strategically and confidently.

This isn’t a transaction. It’s a partnership.

“Our goal isn’t to manage your money. It’s to help you lead your financial life with purpose.”

We work best with people who:

Want a full-picture system, not one-off advice.

Value structure, simplicity, and long-term clarity.

Are ready to coordinate, not just accumulate.

Want to grow wealth with purpose, not pressure.

It starts with one conversation. No pressure. Just clarity.

*Disclaimer: Financial Advisors do not provide specific tax/legal advice and this information should not be considered as such. You should always consult your tax/legal advisor regarding your own specific tax/legal situation. Separate from the financial plan and our role as a financial planner, we may recommend the purchase of specific investment or insurance products or account. These product recommendations are not part of the financial plan and you are under no obligation to follow them. Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods.